Text-to-shop provides consumers with a low-tech option to order products directly from their phone via SMS text messages. Whilst this can benefit retail management, how do Australian consumers feel about one of the more recent global retail trends?

In this article

In Capterra’s previous article on the latest trends in retail eCommerce, we looked at whether cashierless stores would appeal to Australian consumers. In part two, we explore how shoppers might feel about another retail trend, text-to-shop. We surveyed 998 smartphone users to hear their thoughts on the potentially next big thing in retail commerce. The full methodology can be found at the bottom of this article.

What is text-to-shop?

Text-to-shop is the latest in mobile commerce (or m-commerce), where companies sell products via text messaging services without the need for any checkout processes. Whilst this type of conversationalist commerce is not yet available in Australia, it is already being trialled by some big-name retailers in the USA (such as Walmart) and has proven to be popular in China with WeChat for quite some time.

Users create a profile with a brand/store by registering their shipping and billing details. Once customers store their details, they can place purchase orders, responding to automated text messages. A representative can take over if the system does not know how to respond to a customer query.

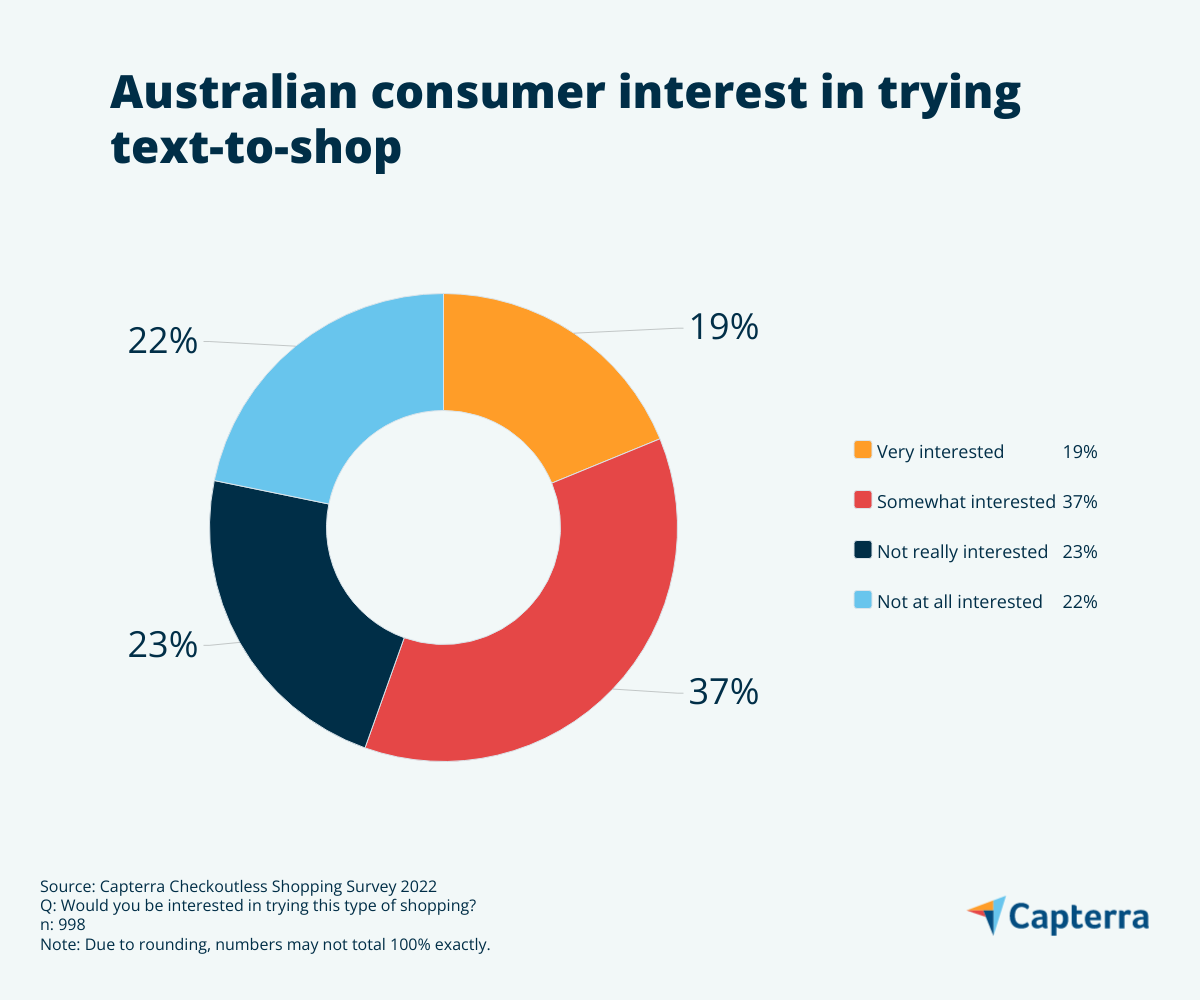

Does the idea of SMS shopping appeal to Australian consumers? Over half of respondents (56%) surveyed by Capterra said they would be interested in trying text-to-shop (19% are ‘very interested’ in this type of shopping whilst 37% are ‘somewhat interested’). This shows the potential for this type of approach to customer service in the eCommerce market. Capterra also found that age played a role in consumers using text-to-shop as 67% of respondents aged 18 to 25 showed an interest compared to 32% of those aged 56 to 65.

We asked survey-takers who expressed an interest which stores they would most likely buy from using the text messaging service. Grocery stores were the most popular store type for respondents, particularly for 40% of those over 65 years compared to just 29% of Gen Z (18 to 25-year-olds). 22% of Gen Z would like to use text-to-shop for clothing stores compared to 17% of those aged 56 to 65, or 15% of those over 65.

How does text-to-shop appeal to consumers?

Text-to-shop can make shopping much more convenient as customers do not need to log in to an account, refill their information, or use any external links. No new technology is needed, and smartphone users of all ages more than likely know how SMS works. Most importantly, the busy consumer can cut down on the time they spend shopping, particularly for groceries.

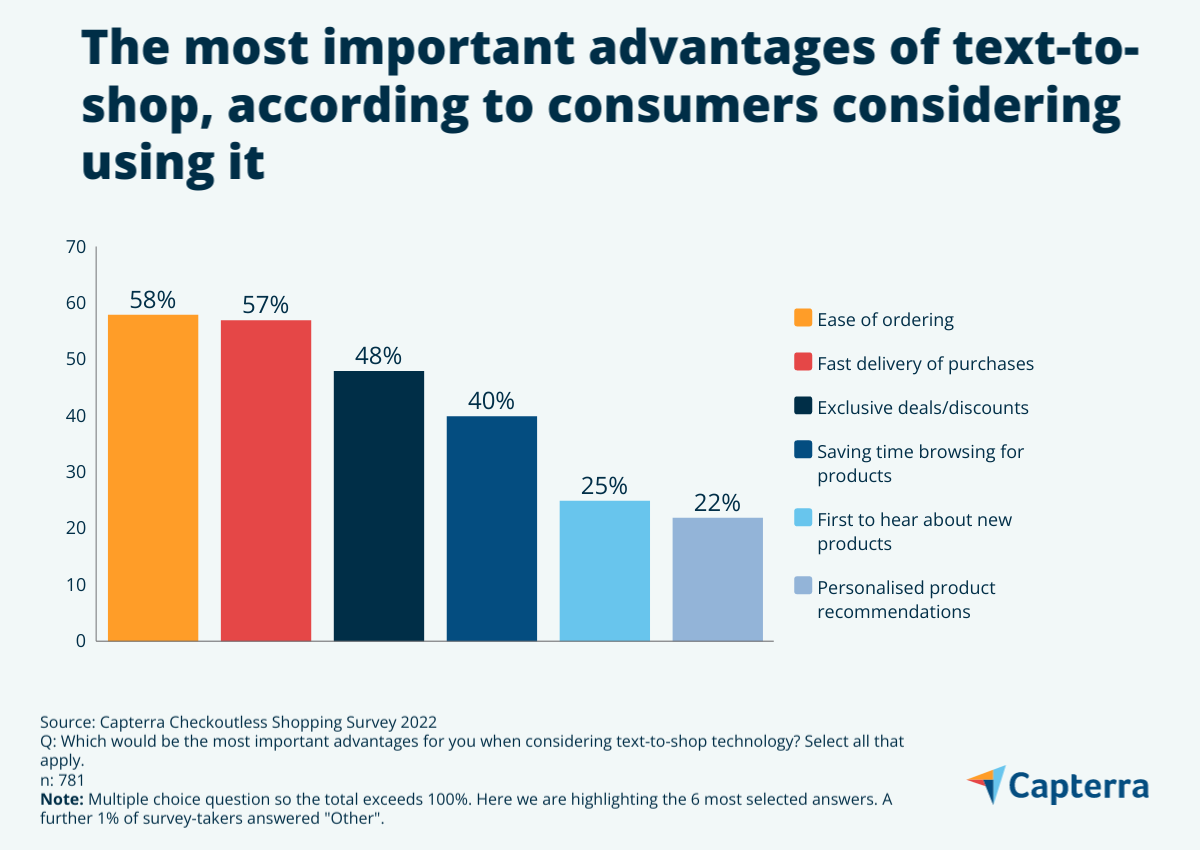

We asked survey-takers interested in trying text-to-shop to select the most important advantages of using this technology. The benefits included ‘ease of ordering’ (58%), ‘fast delivery of purchases’ (57%), and ‘exclusive deals and discounts not being offered elsewhere’ (48%).

As with an email marketing strategy, an SMS strategy can help retailers build or strengthen a relationship with existing and potential customers. It is important to balance the frequency of communication when reaching out to customers about deals or product recommendations so that retailers are neither bombarding nor neglecting consumers.

When asked about being contacted, most of Capterra’s survey-takers (32%) said they would want to receive text messages from their favourite retailers ‘once a week’. Other responses included:

- A few times per week (21%)

- On special occasions (18%)

- Once a month (15%)

- Every day (7%)

- Never (6%)

What are consumer concerns about using text-to-shop?

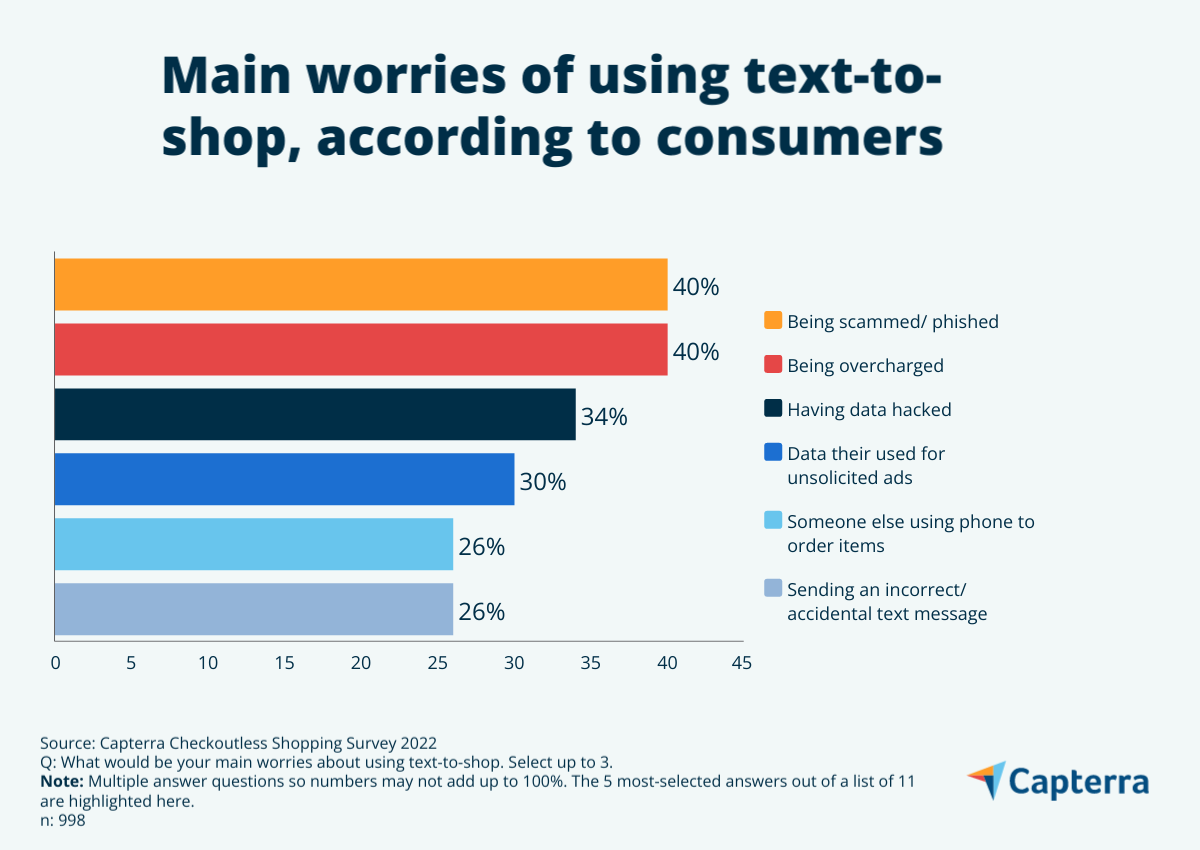

Unfortunately, there can be downsides to using text-to-shop technology, such as security concerns and receiving spam. It comes as no surprise that Capterra found the main worries of survey-takers to include being ‘scammed’ (40%), ‘overcharged’ (40%), and having their ‘data hacked’ (34%).

Just as phishing attacks send out fraudulent emails, smishing text messages can trick people into revealing their personal information or downloading a malicious program to their smartphone. A typical example would be receiving messages from the bank, misinforming victims about a suspicious transaction or advising that their credit card had been blocked. Aside from ignoring such messages, using multifactor authentication adds an extra layer of security and will usually be in the form of receiving a text code.

How valuable is customer purchase history data for retailers?

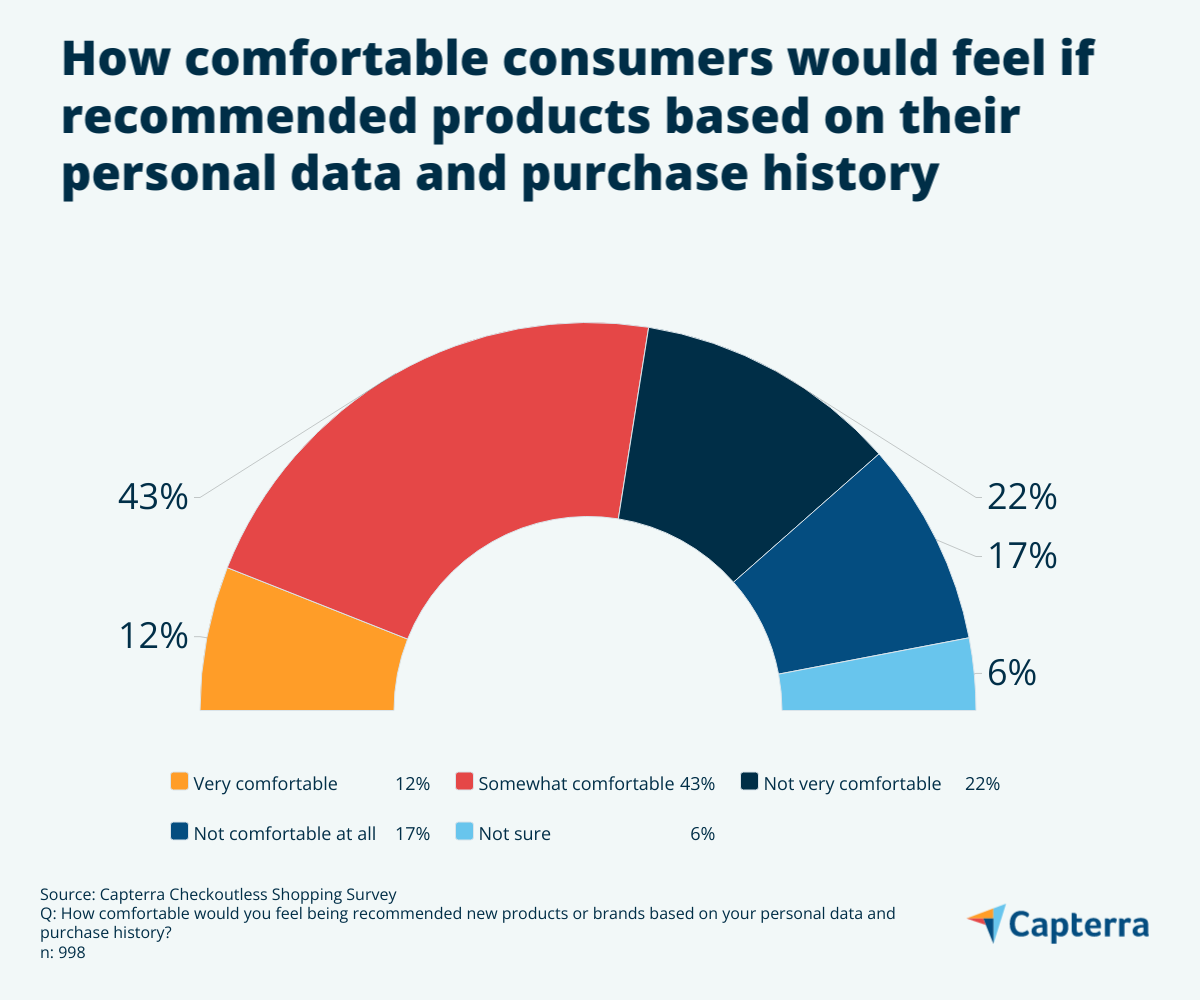

As this type of technology requires consumers to create a personal profile, it allows retailers to collect customers’ purchase history data. Collecting purchase history data enables merchants to understand consumer shopping habits better and can potentially help with customer loyalty. A combined total of 55% of survey respondents said they are comfortable being recommended new products or brands based on their personal data and purchase history (12% are ‘very comfortable’ whilst 43% are ‘somewhat comfortable’).

Creating recommendations for consumers can result in a more personalised shopping experience and improve customer service. It can also help retailers forecast trends and make strategic decisions based on market analysis.

62% of survey-takers said they would find it useful if stores remembered their purchase history and made product suggestions based on this (16% would find it ‘very useful’ and 46% said it would be ‘somewhat useful’). The text-to-shop strategy could also be a beneficial tool in analysing the customer journey. Retailers selling subscriptions can have natural reorder cycles, which not only betters the customer service experience, but can make monthly revenue more predictable.

Is now the time for text-to-shop?

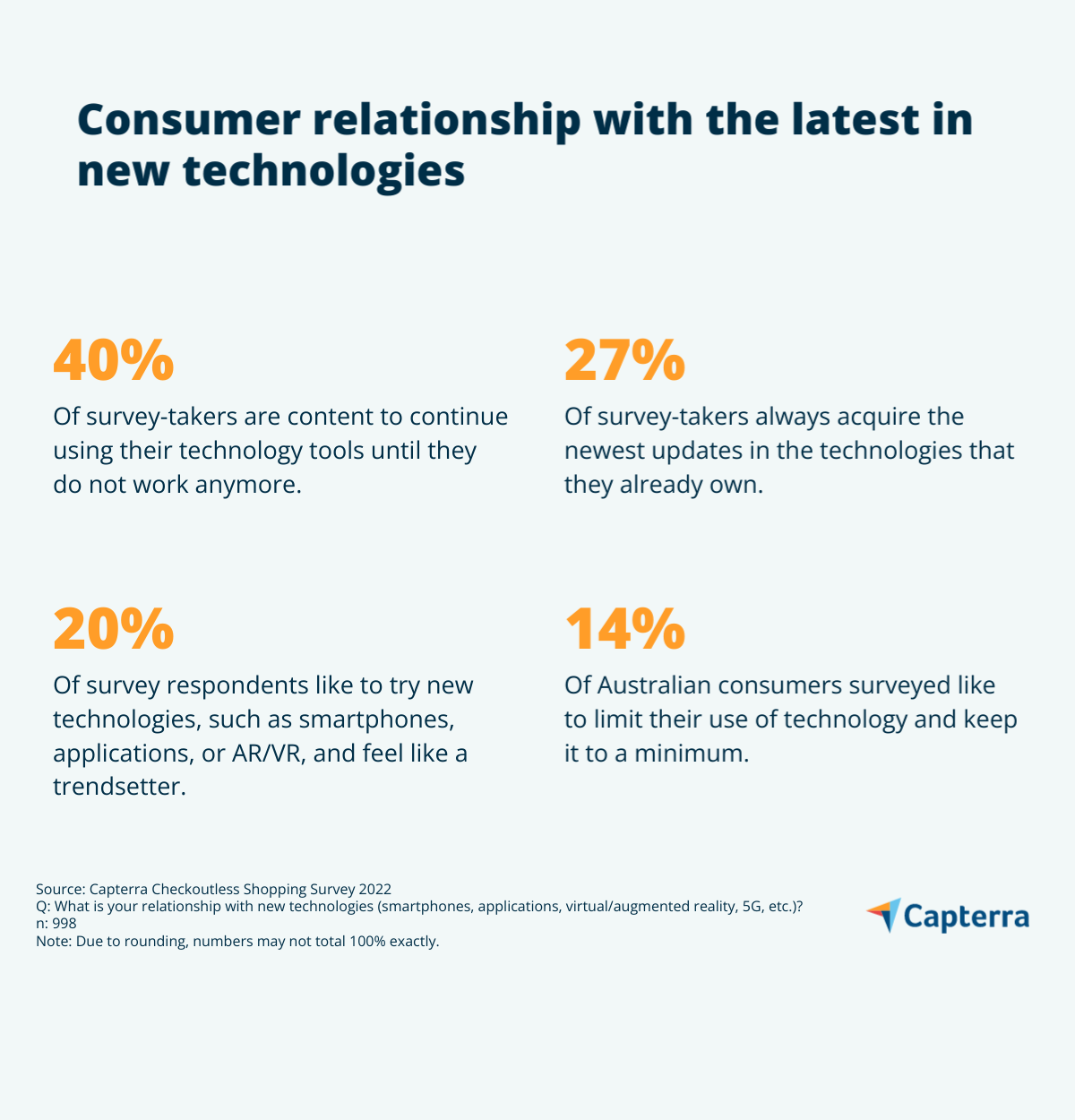

SMS is still one of the most used platforms to date, making it an effective marketing tool integral to point of sales (POS) technology. But how do consumers feel about adapting to newer or updated technologies? Capterra found that 40% of survey-takers are ‘content using the same tools until they don’t work anymore’, which shows that the majority of respondents may not be as quick to adapt to technological change. Text-to-shop isn’t a completely new technology thanks to its use of SMS, which may make it more attractive to most smartphone users, even if they are not particularly tech-savvy.

A quarter of respondents (27%) said they ‘always acquire the newest updates in the technologies that they already own’, meaning there is already potential for consumers to update their phones with text-to-shop. Unsurprisingly, only 7% of those aged 56-65 are interested in acquiring new technology updates compared to 37% of Gen Z, who like to stay up to date on the latest tech trends.

Text-to-shop has yet to launch in Australia, but smartphone owners may find it easier and more convenient to shop online thanks to the rise in m-commerce and conversationalist commerce. Ordering products and goods via text messages is an easy process, making it accessible for everyone to use.

Text-to-shop appears to be an untapped market currently down under, highlighting the potential for less competition from other businesses. Despite consumer concerns about security issues (which retailers will need to take onboard and look to prevent), text-to-shop enables SMEs to connect with customers on a more personal level and improve the customer journey.

Methodology

Data for Capterra’s Checkoutless Shopping survey was collected in April 2022. Results comprise responses from 998 Australian participants. The criteria to be selected for this study are as follows:

- Australian resident

- Aged over 18 years old

- Shops for groceries at least once a month

- Living in an urban or suburban area

- Owns a smartphone