Short-term rental platforms are seen as a contributing factor to the housing affordability crisis in Australia, but could technology help iron out the challenges they bring to the housing market?

In this article

- 57% of Aussie tenants say higher rents are a challenge caused by short term rentals

- Over 80% of Aussie tenants agree that there is a need to limit the amount of short-term rentals and call for local regulations

- Technology can provide an overview of market dynamics and ensure compliance with local councils

There are many factors, such as lack of investment into social and affordable housing and the effects of rising interest rates, that contribute to the housing affordability crisis. In Australia, the housing affordability crisis has sparked debates over short-term rental platforms and their impact on the supply and demand of long-term rentals, which may contribute to higher rental prices.

Over half (57%) of Australian tenants believe that one of the main challenges of short-term rentals is that they create higher prices for long-term rentals due to their effect on the supply and demand of long-term rentals.

The idea behind short-term rental platforms was born out of the sharing economy model, which incentivised owners to monetise underutilised assets such as second homes. However, these platforms witnessed an exponential boom, proving to be a lucrative option for property owners. This has caused challenges for local communities in Australia, and across the globe.

To explore these issues, Capterra conducted a global survey in twelve countries, with a total sample of 4,800 tenants, to uncover their experiences and perceptions of the rental landscape.* Of this sample, 400 respondents reside in Australia. The results showcase the complexity of factors impacting long-term rental tenants, who believe regulations and capping the amount of short-term rentals is necessary to maintain a stable and sustainable housing market. Moreover, they also show the need for solutions, such as compliance software, which can help property managers ensure they are following local regulations.

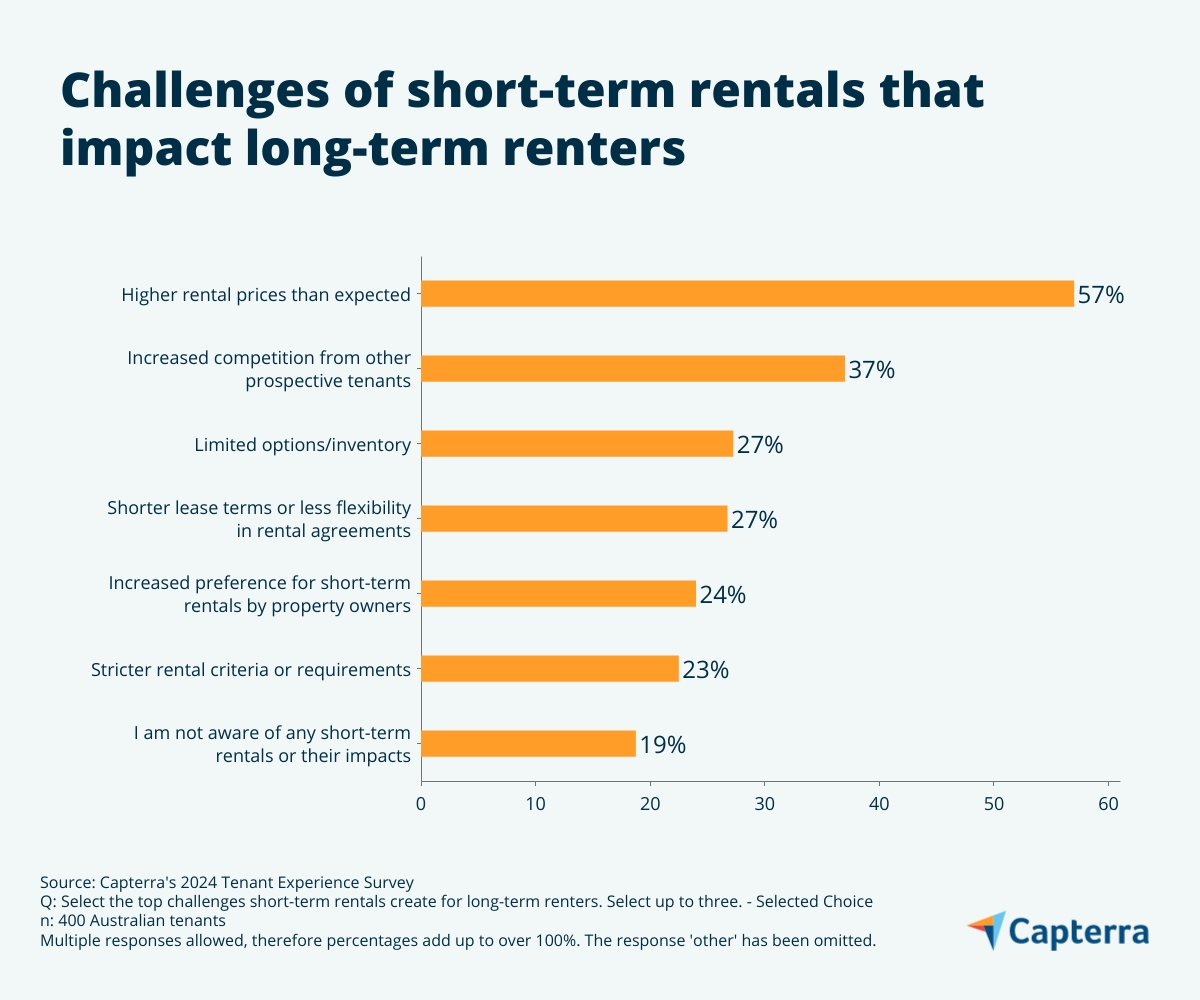

- Long-term rental supply and demand challenges caused by short-term rentals: Australian tenants say higher prices (57%), increased competition (37%), and limited options (27%) are top challenges.

- Short-term rentals are to blame for higher rents, according to many tenants: 42% of Australian tenants that are aware of the impact of short-term rentals say rental prices have increased significantly in their area as a result.

- Consensus for capping and local regulations: Australian tenants agree that limiting short-term rentals would help maintain a stable and sustainable housing market (85%) and local regulations should limit the proliferation of short-term rentals (83%).

57% of Aussie tenants say higher rents are a challenge caused by short term rentals

There have been reports of short-term rentals driving up rental prices in many areas around the country, [1] but is this the reality for the surveyed tenants? Over half (57%) of Aussie renters, cite that higher rental prices are a top challenge derived from short-term rentals.

Additionally, 42% of respondents who are aware of the effects of these types of rentals state that short-term rentals have significantly increased rental prices in their area.

This concern about higher prices highlights the need for property managers to adopt pricing policies that balance profitability with tenant affordability. Similarly, property managers should conduct market analyses to track trends in rental prices that may justify increased rental prices.

High rent is a pressing concern for Australian tenants in global comparison

Many Aussie tenants rent rather than buy properties because they cannot afford to buy their own property (71%) or because they are currently saving to buy one (25%). These numbers are more elevated than the global average, where 55% of global tenants are renting because they cannot afford to buy their own real estate.

Pricing issues are a challenge for tenants, particularly in Australia. Nearly half (48%) of Aussie tenants cite high rental costs as a challenge in their current rental property compared to just over a third (34%) of respondents globally. Additionally, 36% of globally surveyed tenants express dissatisfaction with the amount of rent they are paying. This number is even higher in Australia, where 45% of tenants are dissatisfied with how much they pay for rent.

Moreover, rent increases have significantly affected tenants in Australia: 81% strongly or somewhat agree that rising rents in their area have significantly impacted their standard of living.

In areas where rental prices are soaring, competitor price monitoring software can provide valuable data on local rental demand, occupancy rates, and pricing trends. These tools can provide property managers with an overview of the market in the following ways:

- Market insights: By monitoring short-term rental rates and occupancy, the software provides insights into how these properties are influencing the overall rental market. Property managers can make informed decisions to assess the impact on demand and adjust their pricing strategies.

- Price adjustment: Property owners can use the data to optimise their long-term rental prices. It helps in setting competitive yet fair rates, ensuring long-term rentals remain attractive.

- Supply-demand balancing: The software can highlight trends in supply and demand, helping property managers identify opportunities to convert short-term rentals to long-term rentals where there is increased demand, helping to stabilise rental prices.

- Policy formulation: For Australian policymakers, the data from these tools can help assess the impact of short-term rentals on housing supply and inform regulations aimed at curbing price hikes and maintaining affordable long-term housing.

Over 80% of Aussie tenants agree that there is a need to limit the amount of short-term rentals and call for local regulations

Currently in Australia, local councils are addressing location-specific challenges that short-term rentals are causing in the housing market. As a result, local councils such as Victoria will be introducing a Short Stay Levy Bill–a new 7.5% tax levied on short stay investments in metropolitan and rural areas. The proposed bill is aimed at encouraging investors to return properties to the long-term rental market while also increasing their return on investment.

In other parts of Australia, such as Sydney, local councils are calling for greater regulation of the sector, including a 90-day annual cap and a levy of up to 10% to be applied to all bookings, with revenue to be used for social and affordable housing. [2]

The call for local regulations is widespread, as about eight in ten Australian tenants agree that local regulations should limit the proliferation of short-term rentals in residential areas. Additionally, Aussie tenants also believe that limiting the number of short-term rentals would help maintain a stable housing market for long-term rentals.

Our survey found that increased competition from other prospective tenants (37%) is a top challenge short-term rentals are creating for long-term renters. Increased competition also goes hand in hand with limited supply: just over a quarter (27%) of Aussie tenants identify limited rental options as a key challenge stemming from the prevalence of short-term rentals, justifying calls for local regulations.

Technology can provide an overview of market dynamics and ensure compliance with local councils

Property managers and policymakers can gain a comprehensive view of the short-term rental market and its impact on local housing dynamics by leveraging compliance software and data analytics tools.

These technologies can offer real-time insights into rental demand, pricing trends, and the geographic distribution of listings which can enable greater transparency between short-term rental platforms, property managers, and local governments. Increased transparency can also enable better decision-making and strategic planning. At the same time, automated compliance tools ensure that properties align with zoning laws and regulatory requirements set by local councils.

This dual approach not only fosters fairness and transparency in the market but also helps maintain a balanced housing supply, protecting long-term rental affordability.

Survey methodology

*Capterra's 2024 Tenant Experience Survey was conducted in June 2024 among 4,800 respondents in the U.S. (n=400), Canada (n=400), India (n=400), Brazil (n=400), Mexico (n=400), the U.K. (n=400), France (n=400), Italy (n=400), Germany (n=400), Spain (n=400), Australia (n=400), and Japan (n=400). The goal of the study was to identify the pain points tenants face and explore software solutions property managers can use to address them. Respondents were screened to currently rent their primary residence. For the 400 Australian respondents, candidates had to be Australian residents over the age of 18.

Sources